My Thoughts on The Generative AI Market

Could the next TikTok Influencer with 100M followers be a 1-year-old AI ?

Generative AI products have garnered a lot of attention in the last year with AI models able to produce images, videos, blogs, code and artwork.

The software uses complex machine-learning models, which learn to predict words based on the previous sequence of words. In this article, I will break down some of the breakthroughs in the industry, the emerging business structures and my thoughts on the investment opportunity.

The last 5-years have seen prompt-based AI technology create 0.5x-3x better products but not 10x better ones. There have been some key breakthroughs in AI, but most of these have been confined to the American Technology giants.

AI requires a lot of clean data to feed a model and train the algorithm to be as good, or better than a human. Therefore, companies like Google, Facebook, and Uber have had the most customer data to train such models. However, companies can now use the broader internet to prepare the initial training set.

A recent breakthrough in the way to train large language models came from Google. Transformers are AI models that learn context and meaning by tracking relationships in sequential data, like the words of a sentence; this allows for self-supervised learning without needing human labelled examples. For example, transformers can model the correlation between words irrespective of their position within such phrases.

The combination of transformers and the widespread ability of anyone being able to publish on the internet has resulted in a library of data enabled by zero marginal cost distribution.

Transformers were quickly adopted and implemented at OpenAI to create GPT-1 and, more recently, GTP-3. To make the first text-based prompt products, other companies followed by building transformer models such as Cohere, a21, and Eleuthera.

OpenAI is now the leader in large language models (LLM) APIs. They have trained their models on every single image on the internet. This is no small task, and significant infrastructure investments are required to get the computation necessary to build such a model.

Therefore, using OpenAI, there is no need for a lot of companies to spend substantially on collecting, cleaning and processing data and creating another new eco-system. Now start-ups don’t need to build their models from scratch. Instead, they can build on top of OpenAI’s highly trained model and train the data set to specific use cases like an auto-generated copy.

In other words, with the use of data-centric flywheels, startups can sell to other parties or allows for large companies to build in-house - this has led to the explosive growth of prompt-based AI tools built on innovations like Dall-E, MidJourney, Stable Diffusion, Disco Diffusion, Imagen / Artbreeder and others.

See a photo created by Sequoia Capital on the Generative AI Landscape:

Source: (https://the-decoder.com/sequoia-capital-bets-on-generative-ai-market-map-apps-horizons/)

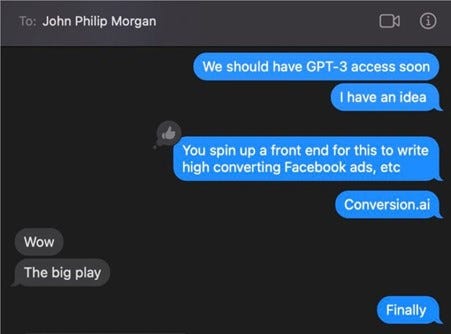

Several startups have capitalised on building on top of the platform and infrastructure layers built by open AI. One company is Jasper.ai which has gone from $0 to 1.65B in 18 months and recently raised a 125m series A.

Take a look at the text message between the founders, which turned into a $1B+ company!

(Source: https://www.linkedin.com/feed/update/urn:li:activity:6993630684938403840/)

With the number of startups operating in this space growing significantly, an industry structure is starting to take shape in the following ways:

1. Platforms & infrastructure: Think of the iPhone and Android, but the AI equivalents. Companies such as Google, Cohere, Stability.ai, and Open.ai build large-scale language models and monetise through APIs.

2. Applications built on top of platforms: The AppStore allowed companies to build new applications using GPS and cameras and create companies like Snapchat, Instagram, Uber, and Doordash. An example of an application built on top of OpenAI platform would be Jasper which has trained its data set to focus on writing marketing copy.

3. Just Add AI: Existing technology companies that add AI where startups lose distribution. During the mobile wave, many technology companies rolled out versions of their product available on mobile. Think of the many startups that tried to create a bank using an app instead of physical stores. However, the winners were banks that added a mobile app. Start-ups' difficulty is targeting markets where someone should just “Add AI”.

It is clear that the market is on the brink of an AI-fuelled industry, and the impending release of GTP-4 next year begs the following question:

Is Now the Right Time to Invest In AI?

To get ahead as a startup, you need to have a significant advantage in the efficiency of your product to overcome the incumbent’s capital, distribution and pre-existing product moats. Or focus on an allotment or customer segment that cannot be served.

GPT-3 created a 5-10x better model than before, which is the catalyst to a new startup ecosystem. Recently, venture capitalists and the general public have been very bullish with respect to AI.

Jasper.ai proves that big business can be built on this infrastructure, but is it sustainable? Do they have a protectable competitive advantage?

I am not yet convinced.

To illustrate this, let’s go back to the early days of crypto, where the best investments were in layer-one protocols like Solana, Ethereum and Bitcoin. As well as enabling platforms like Coinbase, Opensea and Binance.

Poor investments included NFTs and ICOs.

2020-2022 was a massive moment for crypto, but recent events will tell us that it also backfired. Crypto assets have been killed due to widespread investor sell-offs, which have exposed fraudulent companies such as FTX, Luna and Terra, causing shutdowns and bankruptcies.

The next movement will need to be enabled by builders creating high-ROI products for high-value users by solving real problems.

Could the same thing be happening right now in AI? Where will the first set of companies built of GPT-3 rise and fall? Is it a false product market fit?

Is prompt-based AI a strong, sustainable use case?

I believe now is not the right time for a few reasons. First, the sheer number of podcasts and substacks written about the subject in the last 3months, all promoting the “now” is the time in the AI space. I noticed this from a similar pattern occurring in late 2020 regarding NFTs.

The impact of this is a variety of false signals created by the hype cycle. First, creating a new wave of market participants, indicating TAM expansion, a positive sign for investors driving a flurry of invested capital, often leading to increased competition and the majority of funds spent on marketing.

Users who are curious but do not have high ROI are open to experimenting due to increased signals across channels. Myself being a clear example of this type of user. Don’t get me wrong, Jasper is excellent, but I don’t have an actual use case for it and cannot justify the 75 dollars each month. Many of these users will cancel subscriptions after a few months.

This will cause startups to acquire the wrong type of users very quickly and as the TAM expands, user growth will skyrocket. These users will drive a lot of short-term value but not create long-term advantages for the company. Founders will use false signals to decide product features, prioritisation GTM, burn rate and customer success.

Further complications will arise in ecosystem changes as infrastructure improves with releases such as GTP-4. Advancements may change users’ needs making existing products obsolete. Leading to a rollercoaster up and down in ARR.

High ROI users remain un-discovered, are sceptical and are less likely to experiment with new workflows. As a result, companies will have to work hard to discover high-value users and form a strong POV for the market.

If there’s anything to take away from all this, the most dangerous thing you can do as a founder, investor or operator in this space is to misunderstand the value accrual and get trapped by false product-market fit. The pace of advancement is rapid; keep your eyes peeled for the release of GTP-4 next year; the moment might be sooner than we think. In other words, don’t be Gary Vaynerchuk.

Great article with some interesting perspectives! Loved the NFT meme too